The air is thick with anticipation, isn’t it? You can almost taste it – that feeling of a market ready to leap. The Nifty 50 , that bellwether of Indian equities, is dancing tantalizingly close to its all-time high. But here’s the thing: simply knowing it might happen isn’t enough. We need to understand why this is happening, and more importantly, what it means for you, the everyday investor. Let’s dive in, shall we?

Decoding the Bullish Buzz | What’s Fueling the Nifty 50 Rally?

So, what’s behind this surge of optimism? It’s not just one thing; it’s a confluence of factors. First, let’s talk about earnings. Many companies within the Nifty 50 have reported surprisingly strong quarterly results. This isn’t just about numbers; it’s about the underlying health of these businesses. They are innovating, adapting, and showing resilience in a dynamic economic landscape. Strong earnings reports often lead to increased investor confidence, driving up stock prices.

But it’s not solely about internal performance. The global economic climate plays a significant role. For instance, a stable or weakening dollar can make Indian assets more attractive to foreign investors. The promise of infrastructure development and government spending initiatives can also create a positive sentiment for the market. What’s more, expectations around policy decisions from the Reserve Bank of India (RBI) also plays a key role. It’s all a complex dance, and understanding the steps is crucial. To add to the excitement, the buzz around IPO Nov launch has definitely created an uptick in the markets and has fuelled bullish sentiments.

The Ripple Effect | How the Nifty 50 Surge Impacts Your Investments

Okay, so the Nifty 50 might break records. Big deal, right? Wrong! Here’s why you should care. The Nifty 50 is a benchmark. It’s a yardstick against which many mutual funds and other investment products are measured. When the Nifty 50 does well, chances are your equity investments are also doing well. But remember, that is not always the case.

And this is where things get interesting. A rising stock market index can create a ‘fear of missing out’ (FOMO) effect. People see the market going up, and they want a piece of the action. This can lead to a further influx of money into the market, pushing prices even higher. However, this also creates a situation where the market may become overvalued.

A common mistake investors make is chasing returns. They see the Nifty 50 soaring and blindly jump in, without considering their own risk tolerance or investment goals. It’s crucial to have a well-thought-out strategy and stick to it, even when the market is tempting you to do otherwise. Remember theVodafone Idea shares surge? It teaches us that it’s important to see where to put money and what to avoid.

Navigating the Highs | Smart Strategies for a Bullish Market

So, how do you make the most of this potential market rally without getting burned? Here’s my take:

- Review Your Portfolio: Is your portfolio aligned with your risk tolerance and financial goals? This is a good time to rebalance and make sure you’re not overexposed to any particular sector or asset class.

- Stay Disciplined: Don’t let emotions drive your investment decisions. Stick to your plan, even if it means missing out on some short-term gains.

- Do Your Research: Before investing in any company or fund, do your homework. Understand the business, its financials, and its prospects. Don’t rely solely on tips or rumors.

- Consider SIPs: Systematic Investment Plans (SIPs) are a great way to invest in the market gradually, regardless of its current level. This helps to mitigate the risk of investing a lump sum at the wrong time.

Potential Risks on the Horizon | Proceed with Caution

Now, let’s be real. No market rally lasts forever. There are always risks lurking beneath the surface. Rising inflation, geopolitical tensions, or unexpected policy changes could all derail the bullish market sentiment .

One thing I’ve noticed is that many investors get lulled into a false sense of security during a bull market. They forget that markets can go down as quickly as they go up. It’s essential to have a contingency plan in place. What will you do if the market suddenly takes a nosedive? Having a pre-determined exit strategy can help you avoid panic selling and potentially minimize your losses.

The Bottom Line | Informed Optimism is Key

The Nifty 50 might be on the verge of breaking an all-time high. That’s exciting. But excitement alone doesn’t pay the bills. A strong market performance requires informed decision-making. Understand the factors driving the market, assess your own risk tolerance, and stick to a disciplined investment strategy.

And remember, investing is a marathon, not a sprint. There will be ups and downs along the way. The key is to stay focused on your long-term goals and not get swayed by short-term market fluctuations. Now, that is something to look forward to. Indian stock market is now performing better than ever.

FAQ Section

What exactly is the Nifty 50?

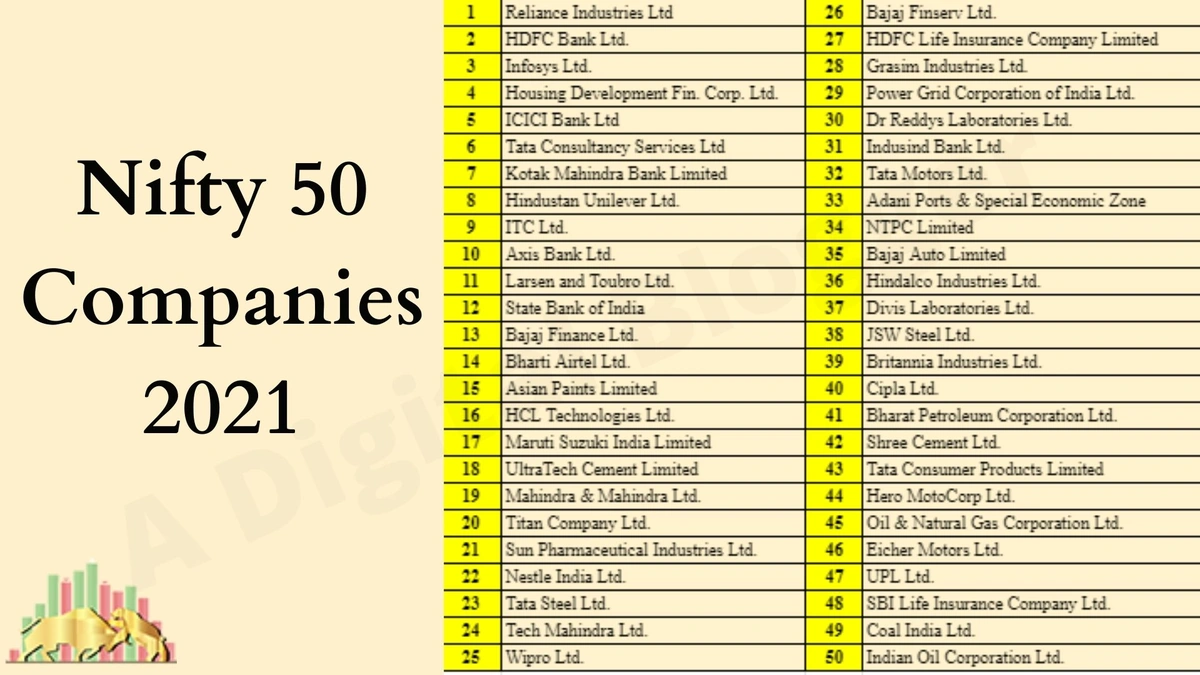

The Nifty 50 is a stock market index representing the weighted average of 50 of the largest Indian companies listed on the National Stock Exchange (NSE). It’s a key indicator of the overall health of the Indian stock market.

How does the Nifty 50’s performance affect my mutual funds?

Many mutual funds use the Nifty 50 as a benchmark. If the Nifty 50 performs well, it’s likely that your equity mutual funds that track the index will also perform well. However, individual fund performance can vary based on the fund manager’s strategy and stock selection.

What should I do if the market starts to decline?

Don’t panic! Review your investment strategy and consider rebalancing your portfolio if necessary. Avoid making impulsive decisions based on short-term market movements. If you’re unsure, consult with a financial advisor.

Is it too late to invest if the Nifty 50 is already at a high?

Not necessarily. The market has the potential to grow in the future. Long-term investing is always advisable, so start with small investments and grow as you earn more. Also, you can consider investing through SIPs to mitigate the risk of investing at a high point.

What are some factors that could negatively impact the Nifty 50?

Several factors could negatively impact the Nifty 50, including global economic slowdown, rising inflation, geopolitical tensions, unexpected policy changes, and poor corporate earnings.

Where can I find reliable information about the Nifty 50?

You can find information about the Nifty 50 on the official NSE website (www.nseindia.com), reputable financial news websites, and from your financial advisor.

Disclaimer: ऊपर दिए गए विचार और सिफारिशें व्यक्तिगत विश्लेषकों या ब्रोकिंग कंपनियों की हैं, न कि "Finance Ghar" की। हम निवेशकों को सलाह देते हैं कि किसी भी निवेश निर्णय लेने से पहले प्रमाणित विशेषज्ञों से परामर्श करें। निवेश में जोखिम होता है और सही जानकारी के बिना निर्णय लेना हानिकारक हो सकता है।